42 formula for coupon payment

Coupon Rate Calculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio Business Financial Insolvency Ratio Cap Rate Capital Gains Yield Capitalization Rate Cash To Current Liabilities Current Ratio Economic Order Quantity. Coupon Rate Formula - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

Excel formula: Calculate payment for a loan | Exceljet Loans have four primary components: the amount, the interest rate, the number of periodic payments (the loan term) and a payment amount per period. You can use the PMT function to get the payment when you have the other 3 components. For this example, we want to find the payment for a $5000 loan with a 4.5% interest rate, and a term of 60 months.

Formula for coupon payment

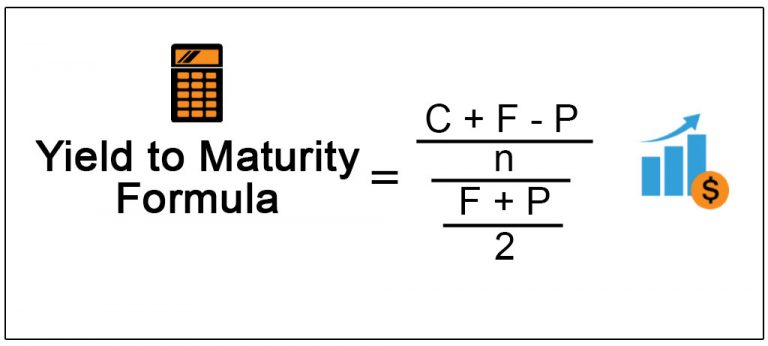

Meaning - My Accounting Course Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall. While he now knows that the corporate bond would have paid him $1500 per year ($10,000 x (0.15)), or $7,500 overall, there was a high risk with that investment, and he is satisfied in a safe, secure $300 per year. How to Calculate a Coupon Payment: 7 Steps (with ... - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. 3 Calculate the payment by frequency. Yield to Maturity (YTM) The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Formula for coupon payment. Annuity Payment - Study Finance Annuity Payment Formula PV_ {Ordinary\: Annuity} = C \times \bigg [ \dfrac {1- (1+r)^ {-n}} {r} \bigg] PVOrdinaryAnnuity =C ×[ r1−(1+r)−n ] C = cash flow per period r = interest rate n = number of payments Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: ... Janet buys a bond for $10,000 that makes coupon payments of $600 after each of the following two years and returns its principal ... Yield to Maturity (YTM) - Corporate Finance Institute C - Interest/coupon payment FV - Face value of the security PV - Present value/price of the security t - How many years it takes the security to reach maturity The formula's purpose is to determine the yield of a bond (or other fixed-asset security) according to its most recent market price. Bond Formulas - thismatter.com C = coupon payment per period; P = par value of bond or call premium; n = number of years until maturity or until call or until put is exercised; Y = yield to maturity, yield to call, or yield to put per pay period, depending on which values of n and P are chosen.

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond Bond Price - XPLAIND.com Since coupon payments form a stream of cash flows that occur after equal interval of time, their present value is calculated using the formula for present value of an annuity. Similarly, since the repayment of principal (maturity value) is a one-off payment at the end of the bond life, the present value of the maturity value is calculated using ... How to Calculate a Coupon Payment After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Advertisement Coupon Rate Formula Examples How do you calculate CPN finance? - FindAnyAnswer.com People also ask, what is the formula for calculating coupon rate? Coupon rateis calculatedby adding up the total amount of annual payments made by a bond, then dividing that by the face value (or "par value") of the bond. For example: ABC Corporation releases a bond worth $1,000 at issue. Every six months it pays the holder $50.

Coupon Rate The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% ... COUPNCD Function - Corporate Finance Institute , we can calculate the date when the first coupon payment is due using COUPNCD. Formula =COUPNCD (settlement, maturity, frequency, [basis]) The COUPNCD function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security. It is the date after the security is traded to the buyer. Coupon Payment - XPLAIND.com Formula Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. Coupon Bond Formula - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment. Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

Using Excel formulas to figure out payments and savings Figure out the monthly payments to pay off a credit card debt. Assume that the balance due is $5,400 at a 17% annual interest rate. Nothing else will be purchased on the card while the debt is being paid off. Using the function PMT(rate,NPER,PV) =PMT(17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two years.

Coupon Payment Formula Coupon Payment Formula; All Time Past 24 Hours Past Week Past month Hot Deals For Coupon Payment Formula. Dream Catio Contest ~ 08/31/2021. No need code. Get Code. Updated 8 months ago. Neuro Peak Brain Support Supplement - Memory, Focus & Clarity Formula - Nootropic Scientifically Formulated...

Coupon Bond Formula - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year.

Coupon Rate Formula - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

How to Find the Coupon Rate - Investopedia In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Zero Coupon Bond Value - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How to use the Excel COUPNCD function | Exceljet Syntax =COUPNCD (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Excel 2003 Usage notes

Post a Comment for "42 formula for coupon payment"