40 how to find the coupon payment

› paymentAZBlue - Payment Info Once you are registered you will be able to make your online payment using a debit card, checking or savings account. Enroll in automatic bill pay: Save time each month with automatic payments. Automatic payments are accepted only after your first payment. Sign up now. Pay over the phone: Call 1-844-729-2583 and when prompted, say, “Member ... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) ... › Finance › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon ...

› Calculate-a-Coupon-PaymentHow to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

How to find the coupon payment

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. › support › residentialFind payment locations | Verizon Fios Billing & Account Authorized payment agents will accept payment at no or low cost to the customer and will also notify Verizon within 30 minutes of a payment that was made. An authorized payment agent will post a sign stating that they accept Verizon Payments. Unauthorized payment agents do charge a fee and do not notify Verizon that a payment was made. AAA - Payment The Automobile Club of Southern California is a member club affiliated with the American Automobile Association (AAA) national federation and serves members in the following California counties: Inyo, Imperial, Kern, Los Angeles, Mono, Orange, Riverside, San Bernardino, San Diego, San Luis Obispo, Santa Barbara, Tulare, and Ventura.

How to find the coupon payment. How to Calculate a Coupon Payment: 7 Steps (with Pictures) 02.08.2020 · To calculate a coupon payment, multiply the value of the bond by the coupon rate to find out the total annual payment. Alternatively, if your broker told you what the bond yield is, you can multiply this figure by the amount you paid for the bond to work out the annual payment. To calculate the actual coupon payment, divide the annual payment ... Coupon Definition - Investopedia Coupon rate or nominal yield = annual payments ÷ face value of the bond Current yield = annual payments ÷ market value of the bond The current yield is used to calculate other metrics, such as the... What Is a Coupon Payment? - Smart Capital Mind A coupon payment often determines the yield of a bond at any given time. Typically dependent on the coupon rate or interest rate of a bond, a coupon payment refers to a payment made to the holder of a bond. A bond is essentially a loan made by one person or agency to another. When someone buys a bond, regardless of whether it is from a company ... Coupon Payment | Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

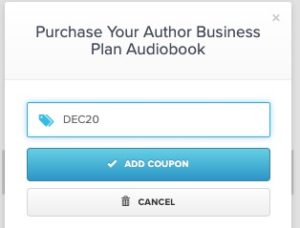

Where to Find Online Coupon Codes and Discover Hidden Discounts When you're ready to check out, open a new browser window to search for online coupon codes. Search the name of the company and "coupons," "coupon codes" or "discount codes." I used the latter when looking for that Western Union code. In the search results, you'll often find websites that have a dozen or more codes to try. How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Coupon Rate Formula Examples Find payment locations | Verizon Fios Billing & Account Find payment locations. Prefer to pay your bill in person rather than online? No problem. Use one of the links below to find a location near you and you’ll be on your way. Payment locations will accept a check or cash as means of payment. Find payment location online Search for a Fios Prepaid payment center. Did You Know? To make bill paying as hassle-free as possible, … How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

Toll payment options | Mass.gov A Pay By Plate MA account is only valid for toll payment on Massachusetts roadways, and does not provide discounts like E-ZPass MA. Pay By Plate MA Registered offers two different payment options. When opening an account, you will be selecting between a … Make A Payment | Republic Finance To make a payment through our payment processors, you must have your account number and birth date. Your assigned branch and account number can be found on your original loan documents or you can call (833) 907-1734 for more information. Republic Finance does not authorize any payment processor to advertise payment processing on our behalf. Please … How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

11 Best Ways to Get Coupons in 2022 - The Coupon Project If you're asking yourself where to find coupons, there's good news - coupons are everywhere! Table of Contents Where Can I Get Coupons? 1. Sunday Newspaper 2. Weekly Grocery Store Ads 3. Online Printable Coupons 4. Digital Coupons 5. Coupon Apps 6. At the Store 7. Social Media 8. Mailing Lists 9. Inside Products and Packages 10. Magazines 11.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Find the coupon date of a bond - Personal Finance & Money Stack Exchange 1 It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says).

How to Calculate Reinvested Bond Interest | Finance - Zacks Multiply the result by the coupon payment amount and subtract the total amount of payments. As an example, if a bond offers a 10 percent YTM rate with 20 annual payments of $50, raise 1.10 to the ...

AZBlue - Payment Info Once you are registered you will be able to make your online payment using a debit card, checking or savings account. Enroll in automatic bill pay: Save time each month with automatic payments. Automatic payments are accepted only after your first payment. Sign up now. Pay over the phone: Call 1-844-729-2583 and when prompted, say, “Member.” Please have your id …

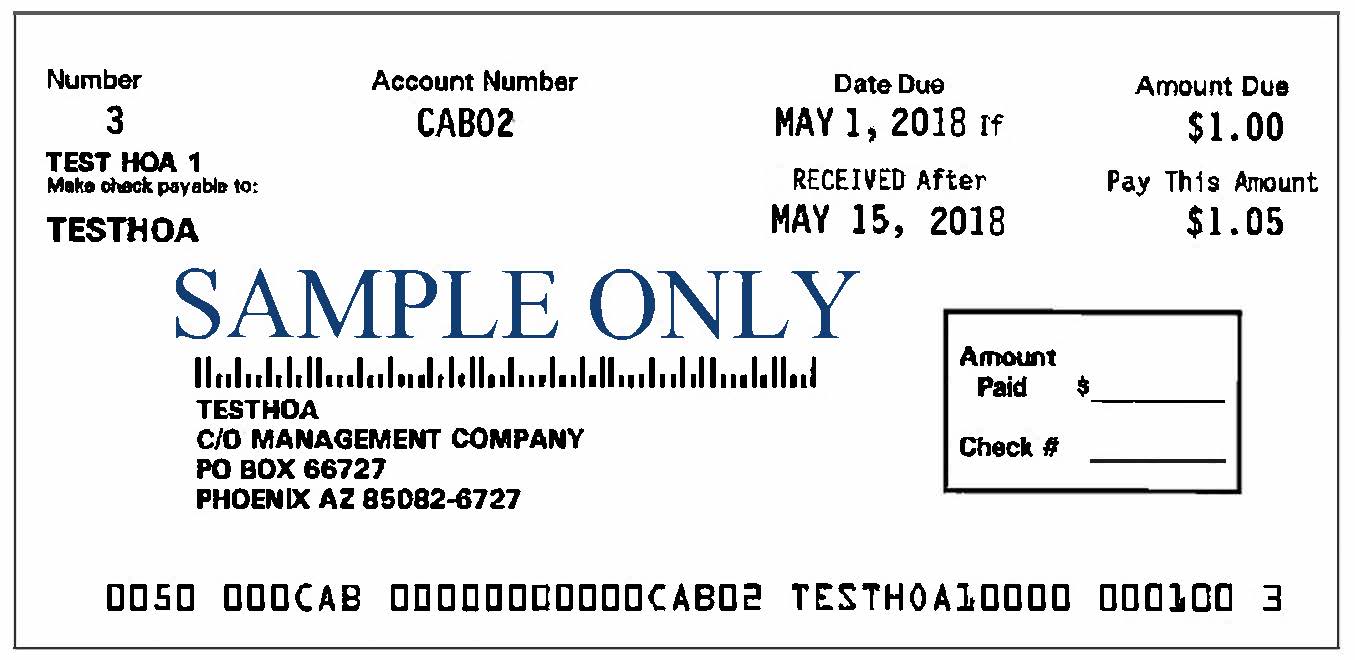

Loan Payment Coupon Book Alternatives - The Balance Your payment coupons just need some basic information to make sure that your payment gets credited properly. Make sure the following items are included in your coupon: Your name and address; Your contact information (especially a phone number to call if there are any questions about your payment)

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders. Coupons are the periodic interest payments received by bondholders from the original date of a bond issuance until the date of maturity - which is determined by the coupon rate as ...

› bills-and-paymentsPayment Options - Columbia Gas of Ohio Find an authorized payment location near you to pay your bill in person. Search Locations. Pay by phone. Call 1-866-694-1828 to make a payment. Our payment vendor ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

Payment Options - Columbia Gas of Ohio Find an authorized payment location near you to pay your bill in person. Search Locations. Pay by phone. Call 1-866-694-1828 to make a payment. Our payment vendor, Paymentus, will charge a $1.75 fee per transaction. Pay by mail. Include your account number on the check or money order, and send it to us using this address: Columbia Gas of Ohio P.O. Box 4629 Carol …

Payment Options - NIPSCO Find your simple and secure payment method. Have an emergency? Natural Gas: If you smell gas, think you have a gas leak, have carbon monoxide symptoms or have some other gas emergency situation, go outside and call 911 and then our emergency number 1-800-634-3524. Electric: For any electric emergency, including a downed power line, power outage or other …

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return. Continuing with the example, if the face value was $1,000, you'd multiply it by 0.025. This results in a semiannual payment of $25. Discounting Future Payment to Present Values

Microsoft Excel Bond Valuation | TVMCalcs.com The purpose of this section is to show how to calculate the value of a bond, both on a coupon payment date and between payment dates. If you aren't familiar with the terminology of bonds, please check the Bond Terminology page. If you aren't comfortable doing time value of money problems using Excel, you should work through those tutorials ...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Post a Comment for "40 how to find the coupon payment"