42 ytm for coupon bond

Yield to Maturity (YTM) Definition - Investopedia 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , … The Returns on a Bond - YTM - The Fixed Income The bond price is calculated from the yield to maturity of the bond, as that is the effective return on the bond. The formula, YTM = C1/ (1+YTM)^1 + C2/ (1+YTM)^2 + C3/ (1+YTM)^3 + ……+ Cn/ (1+YTM)^n + Maturity value/ (1+YTM)^n Here 'C' is the coupon or each installment of interest received,

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

Ytm for coupon bond

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows: Yield to Maturity Calculator How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. bond - Why does the YTM equal the coupon rate at par? - Quantitative ... Intuitively and academically, a bond cannot be worth more than the sum of the future cashflows plus future value. In the case of yield equaling coupon rate, the price is equal to par because the rate at which you are discounting makes it so that the sum of the discounted cashflows and discounted par equal present par. Understanding this, by ...

Ytm for coupon bond. Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Mathematically, the coupon bond formula is represented as, Coupon Bond = C * [ (1- (1 + YTM))^ (-n))/ YTM ]+ [P/ (1 + YTM)^n] where, C = Coupon payment P= Par value YTM = Yield to maturity n = Number of periods until maturity Examples Following examples are given below: Example #1 Yield to Maturity (YTM): Formula and Excel Calculator In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security. An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Bond Price Calculator | Formula | Chart 20/06/2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Yield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime? Yield to Maturity Calculator | Calculate YTM 14/07/2022 · The n for Bond A is 10 years. Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity Calculator Inputs. Current Bond Trading Price ($) - The price the bond trades at today. Bond Face Value/Par Value ($) - The face value of the bond, also known as the par value of the bond. Years to Maturity - The numbers of years until bond maturity.; Bond YTM Calculator Outputs. Yield to Maturity (%): The converged upon solution for the yield to maturity of the … Bond Pricer & YTM Calculator – Calculate Bond Prices and Yields … A bond that pays a fixed coupon will see its bond price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if rates move up to 10%. In order for that bond ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

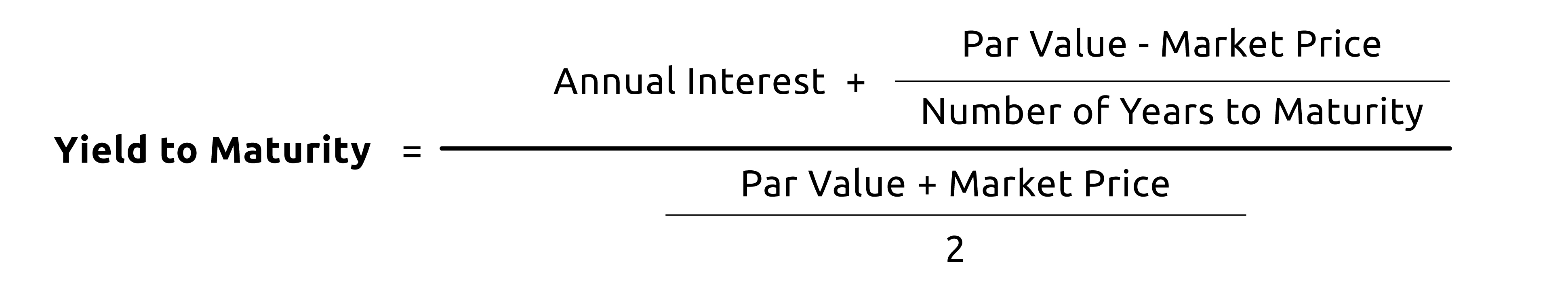

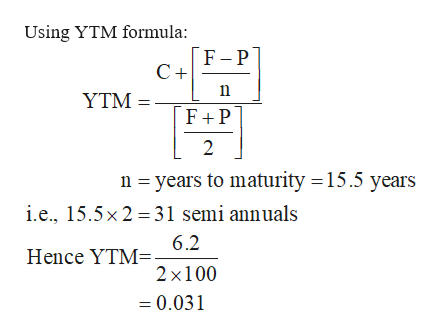

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price.

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox The bond prices for these interest rates are INR 972.76 and INR 946.53, respectively. Since the current price of the bond is INR 950. The required yield to maturity is close to 6%. At 5.865% the price of the bond is INR 950.02. Hence, the estimated yield to maturity for this bond is 5.865%. Variations of Yield to Maturity (YTM) Yield to Call

Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ...

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Difference Between YTM and Coupon rates | Difference Between Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Yield to Maturity (YTM): Formula and Excel Calculator - Wall … What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made …

Post a Comment for "42 ytm for coupon bond"