42 consider a zero coupon bond with 20 years to maturity

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · A bond trader is more likely to consider its yield to maturity. ... payment equals $10 x 2 = $20. The annual coupon rate for IBM bond is thus $20 / $1,000 or 2%. ... Yield to Maturity of a Zero ...

Answered: multible chice, Consider a 20-year bond… | bartleby Business Finance Q&A Library multible chice, Consider a 20-year bond with a 9.5% coupon that has a present yield-to maturity (YTM) of 7.5%. If interest rates remain constant, one year from now the price of this bond will be? why? higher lower the same cannot be determined.

Consider a zero coupon bond with 20 years to maturity

BUS307 Ch6 Participation and HW Flashcards | Quizlet 25 -year zero-coupon bonds. If the yield to maturity on the bonds will be 7% (annual compounded ... Consider a zero-coupon bond with a $5,000 face value and 20 years left until maturity. If the bond is currently trading for $2,130 , then the yield to maturity on this bond is closest to: Principles of Investments- Chapter 10 Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 5% and a par value of $1,000. ... a. $458.11. Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 8.00% D 4 8.50% E 5 10.25% The expected 1-year interest rate in the third year should be _____. ... Consider the expectations ... Solved Consider a zero coupon bond with 20 years to - Chegg See the answer Consider a zero coupon bond with 20 years to maturity. The price will this bond trade if the YTM is 6% is closest to: Expert Answer 100% (1 rating) Price of a Zero coupon bond = Face value * ( 1 + r)-n Fa … View the full answer Previous question Next question

Consider a zero coupon bond with 20 years to maturity. Solved Consider a zero coupon bond with 20 years to | Chegg.com Expert Answer Given the following information, Years to maturity = n = 20 Assume Face value = FV = 1000 When yield to maturity = YTM = 7% = … View the full answer Transcribed image text: Consider a zero coupon bond with 20 years to maturity. What will happen to the price of the bond if its yield to maturity decreases from 7% to 5%? A. 25 consider a zero coupon bond with 20 years to - Course Hero 25) Consider a zero coupon bond with 20 years to maturity and a face value of $1000. The price will this bond trade at if the YTM is 6% is closest to: A) $215 B) $312 C) $335 D) $306 Answer: Explanation: B)FV= 1000 I= 6 PMT= 0 N=20 ComputePV = 311.80 or, PV = FV (1+i) = 1000 20(1+.06) = 311.80B N. ECO389 HW 2 - Solutions Use the information for ... Solved Consider a zero coupon bond with 20 years to - Chegg Finance questions and answers. Consider a zero coupon bond with 20 years to maturity. The amount that the price of the bond will change if its yield to maturity decreases from 7% to 5% is closest to: A. $120 B. minus− $53 C. $53 D. $673. Question: Consider a zero coupon bond with 20 years to maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin...

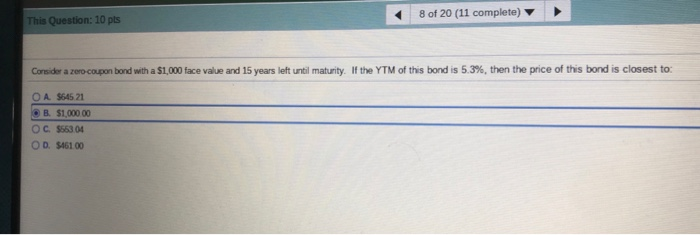

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Thus, the most responsive bond has a long time to maturity (usually 20 to 30 years) and makes no interest payments. Therefore, long-dated zero-coupon bonds respond the most to interest rate changes. 6.2.2 Flashcards | Quizlet C) The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment. D) When prices are quoted in the bond market, they are conventionally quoted in increments of $1,000. D Consider a zero-coupon bond with $100 face value and 15 years to maturity. Answered: Consider a zero-coupon bond with a… | bartleby Transcribed Image Text: Consider a zero-coupon bond with a $1,000 face value and 10 years left until maturity. If the YTM of this bond is 11.2%, then the price of this bond is closest to: O A. $415.08 O B. $346.00 O C. $1,000.00 O D. $484.26.

Bond questions Flashcards | Quizlet High-yield bonds are considered "investment" grade. True False. ... What is the current price of a zero-coupon bond with a 7 percent yield to maturity that matures in 20 years? $1,000 $2,582 $25.82 $258.42 $100.00. ... Calculate the yield to maturity of a zero-coupon bond with a face value of $1000, maturing in 10 years, and selling for a price ... Consider a zero coupon bond with 1000 face value and - Course Hero California State University, Fullerton FIN FIN MISC Consider a zero coupon bond with 1000 face value and 20 years to maturity The Consider a zero coupon bond with 1000 face value and School California State University, Fullerton Course Title FIN MISC Uploaded By rubycloct Pages 16 Ratings 96% (323) This preview shows page 5 - 8 out of 16 pages. › what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Another type of bond is a zero coupon bond, which does not pay interest during the time the bond is outstanding. Rather, zero coupon bonds are sold at a discount to their value at maturity. Maturity dates on zero coupon bonds tend to be long term, often not maturing for 10, 15, or more years. Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Solved Consider a zero-coupon bond with 20 years to - Chegg Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306. OB. $312 O c. $335. O D. $215. Question: Consider a zero-coupon bond with 20 years to maturity. The price at which this bond will trade if the YTM is 6% is closest to: Select one: O A. $306.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53. Example 2 ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Consider a zerocoupon bond with 1000 face value and 20 years to ... Consider a zerocoupon bond with 1000 face value and 20 years to maturity The from BUSINESS BFF5954 at Monash University. Study Resources. Main Menu; by School; by Literature Title; by Subject; ... Consider a zerocoupon bond with 1000 face value and 20 years to maturity The. Consider a zerocoupon bond with 1000 face value and.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ...

Solved Consider a zero coupon bond with 20 years to maturity - Chegg 1) The current yield is: 2). The yield to maturity is: Please show work. Question: Consider a zero coupon bond with 20 years to maturity and $25,000 face value if the current market price is $15,000. (Use semiannual compounding in your calculations). 1) The current yield is: 2). The yield to maturity is: Please show work.

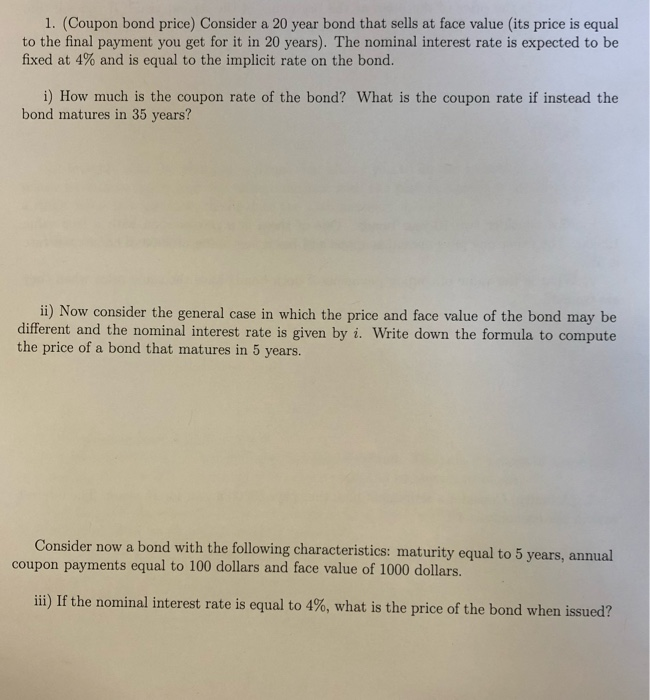

› calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market.

Answered: Consider a zero-coupon bond with a… | bartleby Business Finance Q&A Library Consider a zero-coupon bond with a $1,000 face value and 10 years to maturity. The price this bond will trade if the Yield To Maturity is 7.1% is closest to: A) $604.35 B) $805.8 C) $705.07 D) $503.62 Consider a zero-coupon bond with a $1,000 face value and 10 years to maturity.

Post a Comment for "42 consider a zero coupon bond with 20 years to maturity"