42 coupon rate formula calculator

What is a Coupon Rate? - Definition | Meaning | Example In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder. How to Calculate ROI from Coupons & Discounts? - Voucherify Let's start off with an easy one; You want to push out a public, fixed-code code to promote your brand. Something that can be shared on Groupon or ad banners, e.g. "voucherify-black-friday". You can create it in minutes with the Voucherify manager. Just to remind you, Voucherify supports five types of discounts: Amount (e.g. $10 off),

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Coupon rate formula calculator

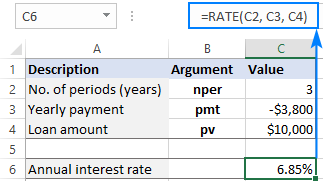

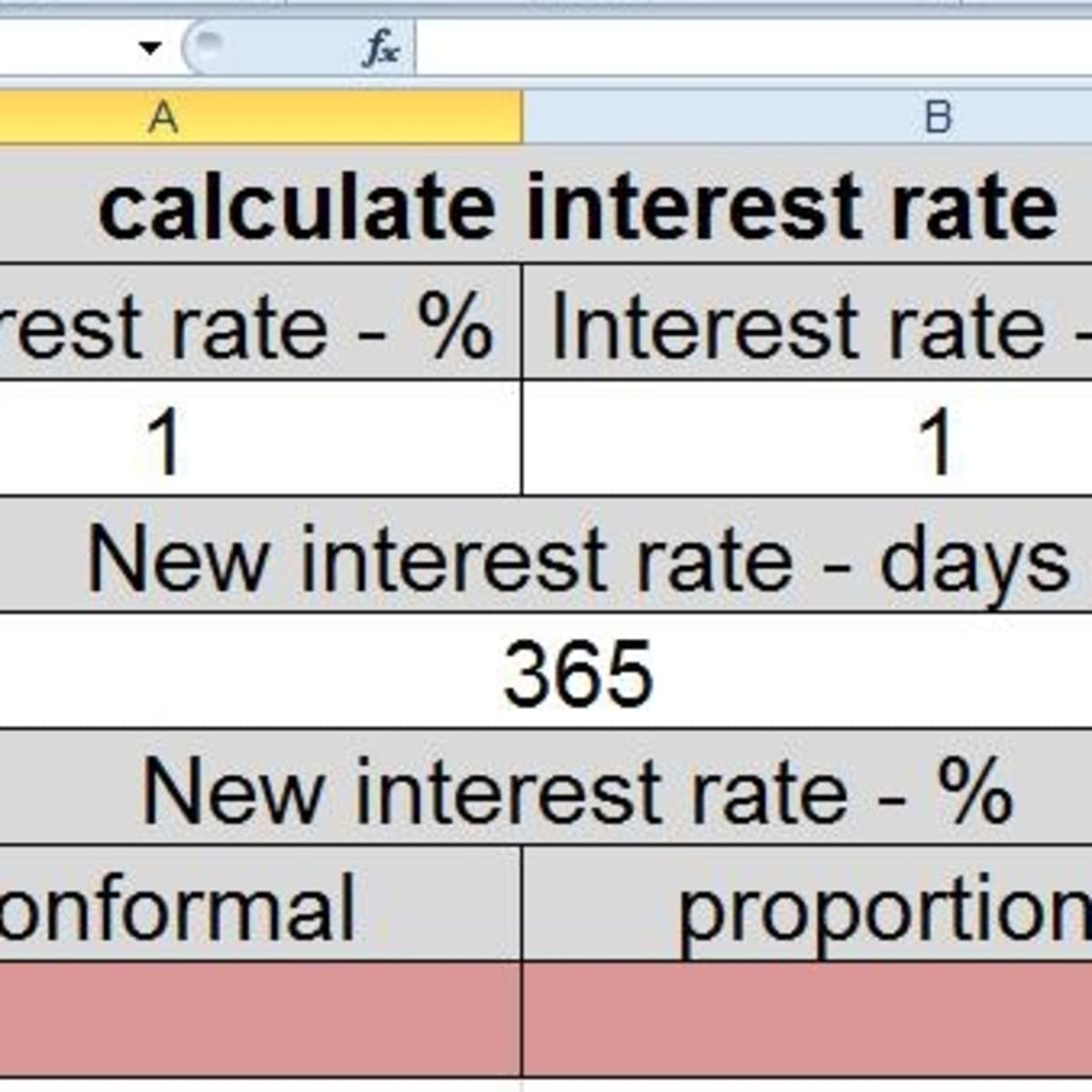

Discount Rate Calculator - The Discount Calculator What is Discount Rate Calculator ? The discount rate calculator is a free online tool. It calculates the discount rate by using future cash flows, present value, and the number of years input data. Discount Rate Formula. DR = ((FCF / PV ) ^ 1/n - 1)*100. Where DR is the discount rate; FCF is the future cash flows; PV is the present value Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ... Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates

Coupon rate formula calculator. Detailed Coupon Percentage Rate Calculation - MYMATHTABLES.COM Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is calculated by dividing annual coupon payment by face value of bond.The formula is expressed as follows Coupon Rate formula = ( (Coupon Payment*Frequency of Payment) / Face Value) × 100 See Also Begining Inventory Calculator Ending Inventory Calculator What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a … Formula to calculate the coupon rate of a bond| Knowledge Center IIFL ... Coupon Rate = (Annual Coupon Payment / Face Value of Bond) * 100 Let's say you want to buy a Rs 1,000 bond that pays Rs 40 in interest every year. The coupon rate would be 4 (40/1000 * 100)....

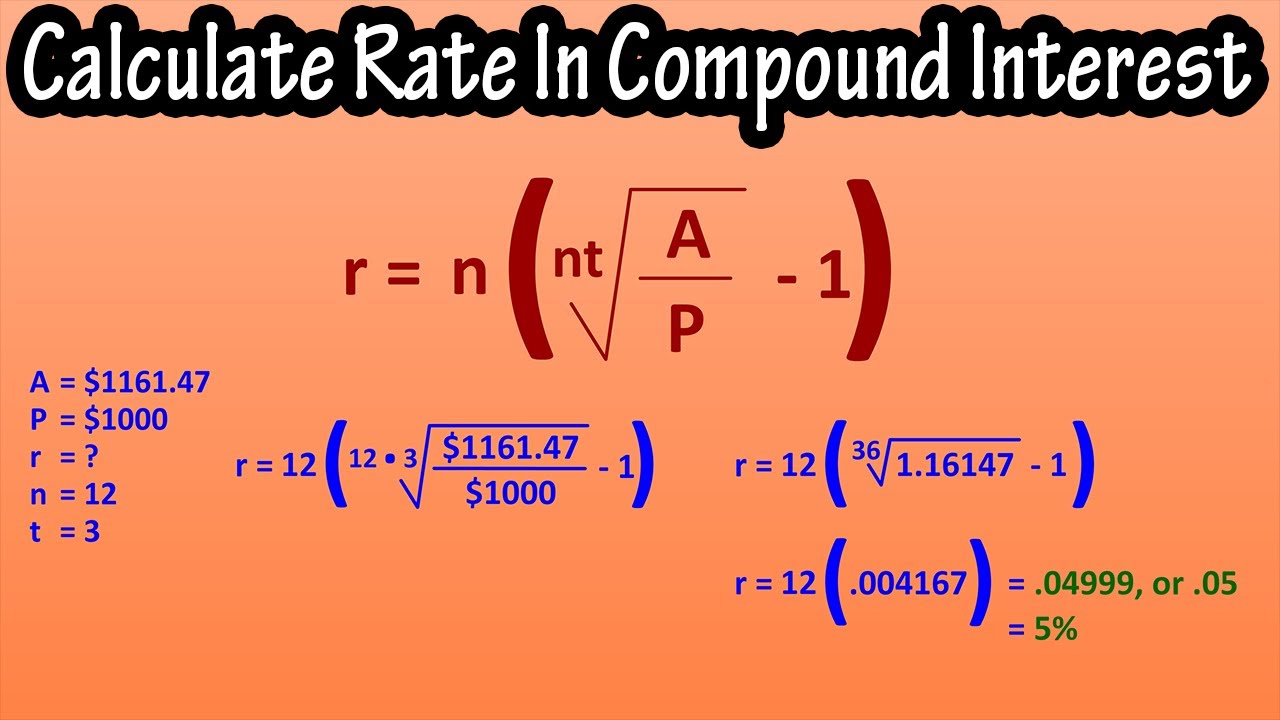

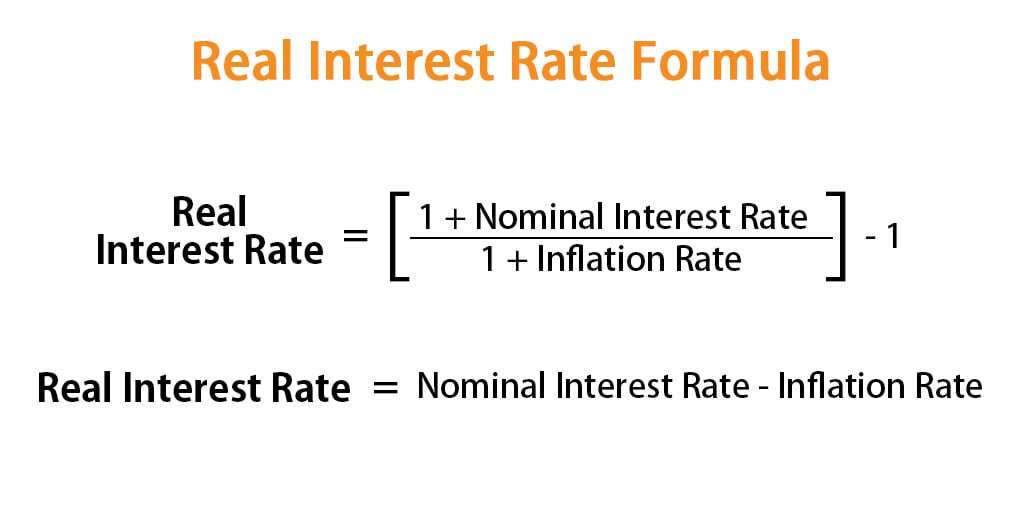

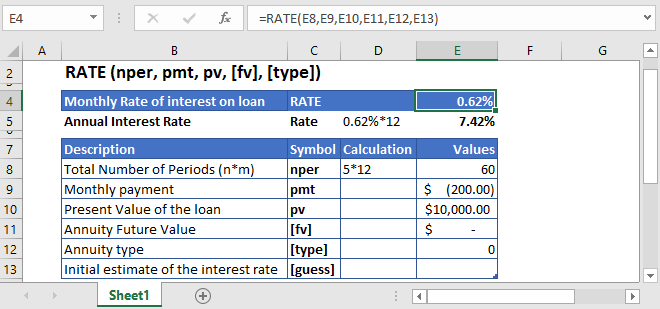

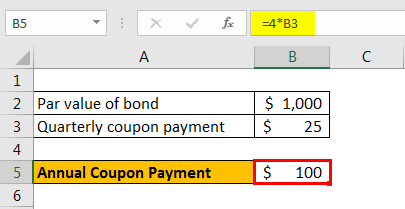

Internal Rate of Return (IRR): Formula and Calculator - Wall … If we were to calculate the IRR using a calculator, the formula would take the future value ($210 million) and divide by the present value (-$85 million) and raise it to the inverse number of periods (1 ÷ 5 Years), and then subtract out one – which again gets us 19.8% for the Year 5 internal rate of return (IRR). Coupon Rate Calculator | Bond Coupon 15.07.2022 · The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate Coupon Payment | Definition, Formula, Calculator & Example Formula. Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Yield to Maturity Calculator | Good Calculators CR is the coupon rate. Example 1: What is the current yield of a bond with the following characteristics: an annual coupon rate of 7%, five years until maturity, and a price of $800? Solution: The yearly coupon payment is $1000 × 7% = $70, using the formula above, we get: CY = 70 / 800 * 100. CY = 8.75%, The Current Yield is 8.75%

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Formula The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Annualized Rate of Return Formula | Calculator - EDUCBA The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. ... Annualized Rate of Return Formula Calculator. You can use the following Annualized Rate of Return Formula Calculator.

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ ... Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value . Related Calculators Acid Test Ratio Business Financial Insolvency Ratio Cap Rate Capital Gains Yield Capitalization Rate ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Coupon Rate: Formula and Bond Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula Calculator; Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity.

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form.

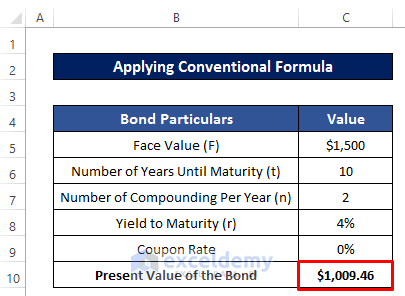

Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically …

Zero-Coupon Bond: Formula and Calculator [Excel Template] If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon Rate Template - Free Excel Template Download C = Coupon rate I = Annualized interest P = Par value, or principal amount, of the bond More Free Templates For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates. Excel Modeling Templates PowerPoint Presentation Templates

Coupon Bond Formula | Examples with Excel Template - EDUCBA The formula for coupon bond can be derived by using the following steps: Step 1: Firstly, figure out the par value of the bond being issued and it does not change over the course of its tenure. It is denoted by F. Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon ...

Discount Rate Calculator - The Discount Calculator What is Discount Rate Calculator ? The discount rate calculator is a free online tool. It calculates the discount rate by using future cash flows, present value, and the number of years input data. Discount Rate Formula. DR = ((FCF / PV ) ^ 1/n - 1)*100. Where DR is the discount rate; FCF is the future cash flows; PV is the present value

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

![Coupon Rate: Formula and Bond Yield Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/10222811/Coupon-Rate-Formula-960x300.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 coupon rate formula calculator"