43 definition of coupon rate

Coupon Definition - Investopedia What Is a Coupon? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually... What is the Coupon Rate? - Realonomics The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond. The coupon rate is the yearly amount of interest that will be paid based on the face or par value of the security.

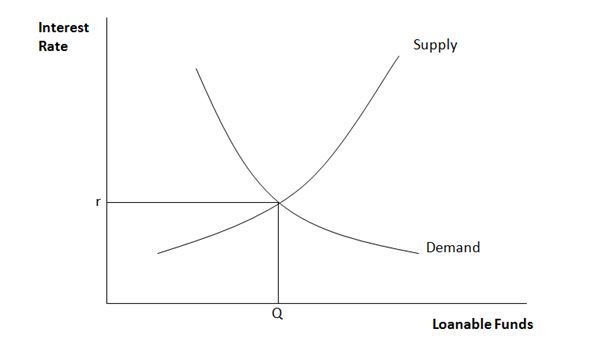

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

Definition of coupon rate

Coupon rate definition and meaning | Collins English Dictionary noun ( Finance: Investment) The coupon rate is the interest rate on a bond calculated on the number of coupons per year . A tax-exempt municipal bond has a higher after-tax yield than a corporate bond with the same coupon rate . This five-year paper has a coupon rate of 6 percent. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. Clickthrough rate (CTR): Definition - Google Ads Help Clickthrough rate (CTR) can be used to gauge how well your keywords and ads, and free listings, are performing. CTR is the number of clicks that your ad receives divided by the number of times your ad is shown: clicks ÷ impressions = CTR.

Definition of coupon rate. Coupon Rate Formula | Step by Step Calculation (with Examples) Dave said that the coupon rate is 10.00%. Harry said that the coupon rate is 10.53%. Annual Coupon Payment. Annual coupon payment = 4 * Quarterly coupon payment. = 4 * $25. = $100. Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be -. What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean? Definition of - Coupon Rate Explained | Course Eagle Definition of Coupon Rate Coupon rate is the rate of interest that a debt instrument offers to its holder, calculated on the face value of the instrument until the maturity. Normally coupon is paid periodically. It can be paid monthly, quarterly, semi-annually, or annually. Example of Coupon Rate: Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Coupon Definition & Meaning - Merriam-Webster 1 : a statement of due interest to be cut from a bearer bond when payable and presented for payment also : the interest rate of a coupon 2 : a small piece of paper that allows one to get a service or product for free or at a lower price: such as a : one of a series of attached tickets or certificates often to be detached and presented as needed b Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. Discount Rate - Definition, Types and Examples, Issues Discount Rate Example (Simple) Below is a screenshot of a hypothetical investment that pays seven annual cash flows, with each payment equal to $100. In order to calculate the net present value of the investment, an analyst uses a 5% hurdle rate and calculates a value of $578.64. This compares to a non-discounted total cash flow of $700.

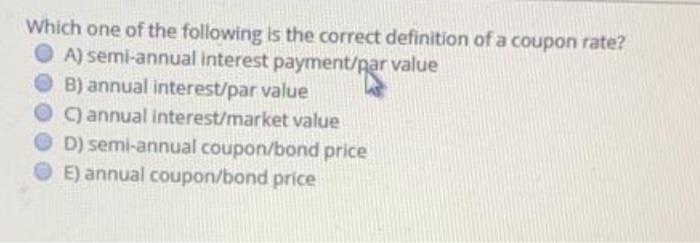

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate is the annualized interest also referred to as the coupon, divided by the initial loan amount. The initial loan amount is the par value. In the example given, the coupon rate is the... Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence? Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon rate Definition | Nasdaq Coupon rate. In bonds, notes, or other fixed income securities , the stated percentage rate of interest, usually paid twice a year.

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond.

Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate. The main difference between Coupon Rate and Interest Rate is that the coupon ...

Coupon rate Definition & Meaning | Dictionary.com coupon rate noun the interest rate fixed on a coupon bond or other debt instrument. Words nearby coupon rate coupon, coupon bond, coupon clipper, couponer, couponing, coupon rate, coup stick, courage, courage of one's convictions, have the, courageous, courant

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate Definition: 2k Samples | Law Insider Examples of Coupon Rate in a sentence. Distributions in arrears for more than one quarter will bear interest thereon compounded quarterly at the Coupon Rate (to the extent permitted by applicable law).. The Trust shall also appoint a Calculation Agent, which shall determine the Coupon Rate in accordance with the terms of the Securities.. Despite such deferral, quarterly Distributions will ...

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing What is the Coupon Rate? The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations.

Glossary of Municipal Securities Terms The periodic rate of interest, usually calculated as an annual rate payable on a security expressed as a percentage of the principal amount. The coupon rate, sometimes referred to as the "nominal interest rate," does not take into account any discount or premium in the purchase price of the security. See: COUPON BOND; INTEREST RATE.

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Learn About Coupon Interest Rates | Chegg.com The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond. To visualize in the percentage form, this value is multiplied by 100. With the help of the following example, one can easily understand the concept of coupon rates.

Difference Between Coupon Rate and Required Return Definition: The coupon rate is the amount of interest that the buyer of the bond will receive annually. The required return is the percentage of return of bond assuming that the asset is withheld by the investor until the bond matures. Formula Coupon rate = ( Total annual payment/par value of bond) * 100 ...

Clickthrough rate (CTR): Definition - Google Ads Help Clickthrough rate (CTR) can be used to gauge how well your keywords and ads, and free listings, are performing. CTR is the number of clicks that your ad receives divided by the number of times your ad is shown: clicks ÷ impressions = CTR.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon rate definition and meaning | Collins English Dictionary noun ( Finance: Investment) The coupon rate is the interest rate on a bond calculated on the number of coupons per year . A tax-exempt municipal bond has a higher after-tax yield than a corporate bond with the same coupon rate . This five-year paper has a coupon rate of 6 percent.

![Fixed Interest Rate: Formula and Loan Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/13173150/Fixed-Interest-Rate-Formula.jpg)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-interest-rate-and-annual-percentage-rate-apr-Final-3d91f544524d4139893546fc70d4513c.jpg)

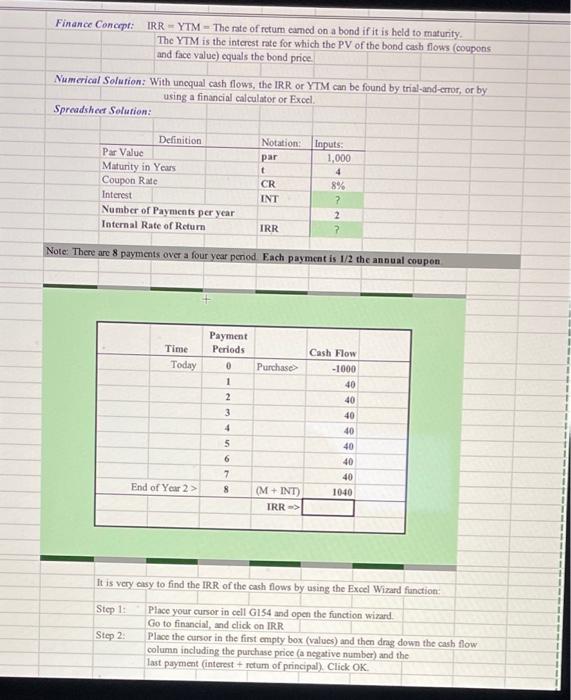

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "43 definition of coupon rate"