43 yield to maturity of a coupon bond formula

How to Calculate Yield to Maturity: 9 Steps (with Pictures) 06.05.2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date. Yield to Call (YTC): Bond Formula and Calculator - Wall Street Prep Yield Excel Function. Yield to Call (YTC) = "YIELD (settlement, maturity, rate, pr, redemption, frequency)". Specific to the yield to call, "maturity" is set to the earliest call date while "redemption" is the call price. The yield to call (YTC) on our bond is 9.25%, as shown by the screenshot of our model below.

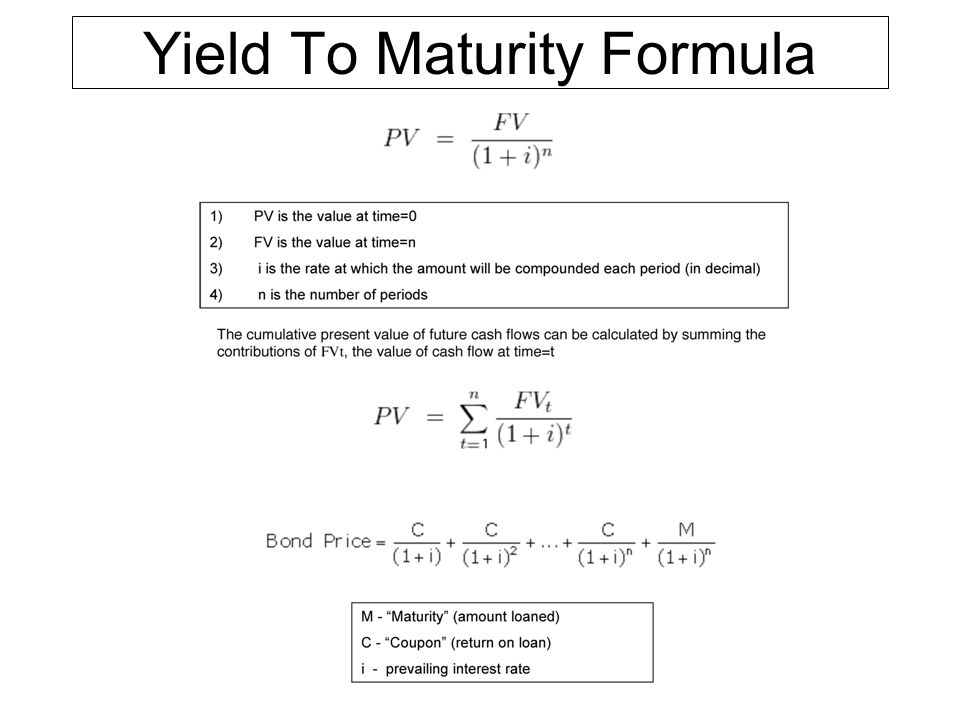

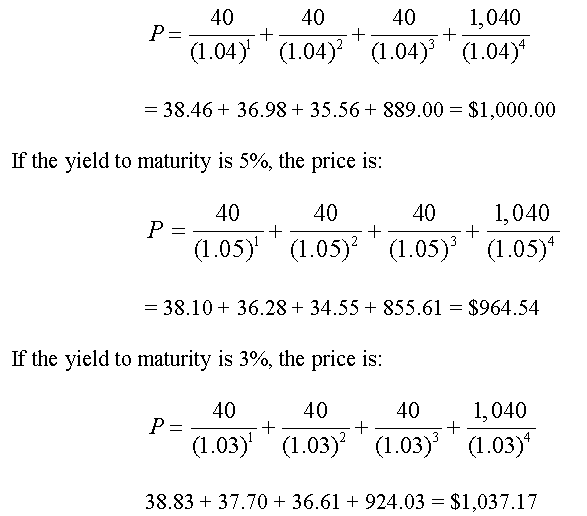

Yield to Maturity (YTM): Formula and Calculator - Wall Street Prep Even for bonds consisting of different maturities and coupon rates, the YTM enables comparisons to be made since the YTM is expressed as an annualized rate regardless of the bond's years to maturity. Yield to Maturity Formula. The formula for calculating the yield to maturity (YTM) is as follows.

Yield to maturity of a coupon bond formula

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... filmux top - xjypc.melintasiberita.info Define yield to maturity of a bond/security.Yield to Maturity or YTM is key ratio of fixed-income bond or security in terms of rate of return earned over the total period. YTM also known as interest rate to be received on a bond when a holder bought it and retained it till maturity.Theoretical formula to calculate the YTM (Yield to Maturity).Use the formula: The rate of yield comes out to be 0 ...

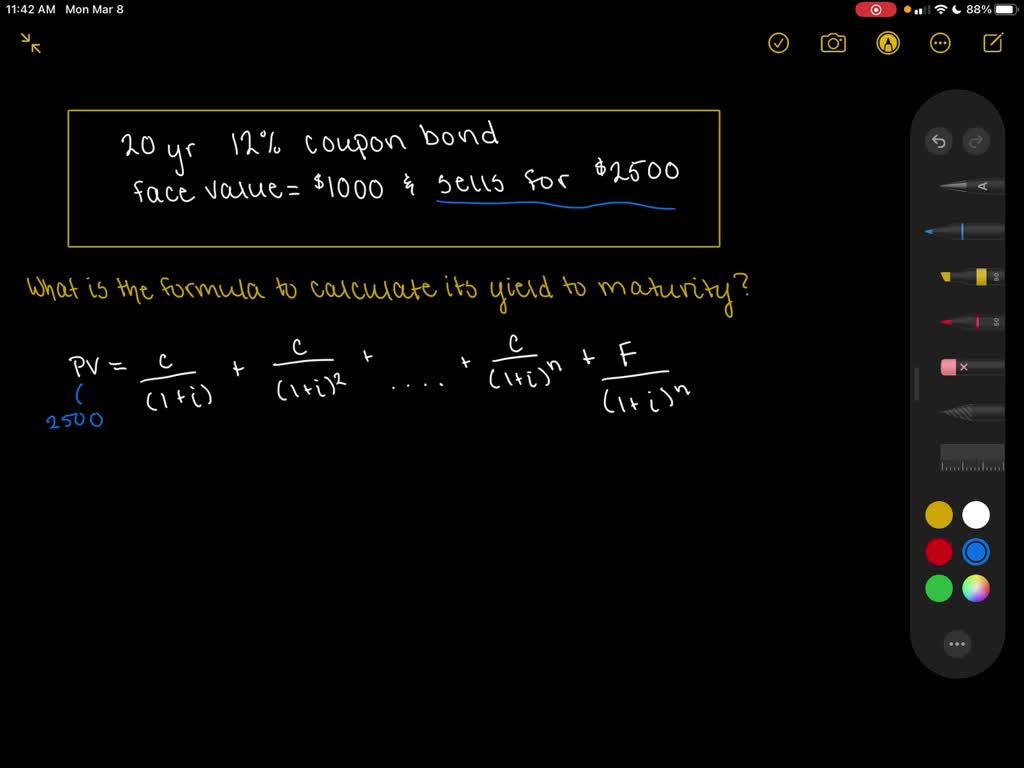

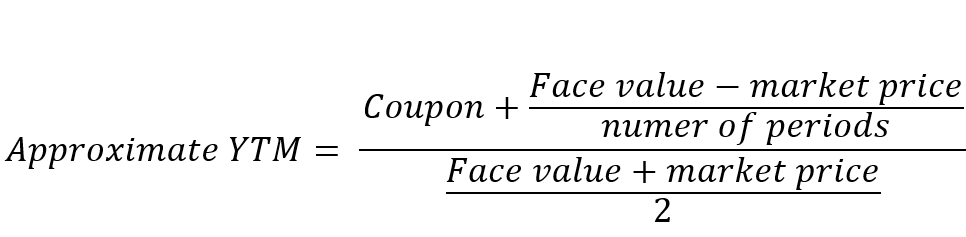

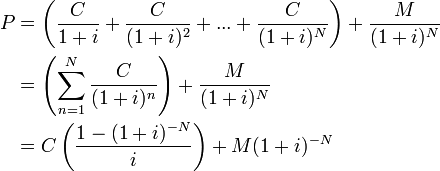

Yield to maturity of a coupon bond formula. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, YTM = Yield to maturity n = No. of periods till maturity Table of contents Bond Yield to Maturity (YTM) Calculator - DQYDJ Estimated Yield to Maturity Formula. However, that doesn't mean we can't estimate and come close. The formula for the approximate yield to maturity on a bond is: ( (Annual Interest Payment) + ( (Face Value - Current Price) / (Years to Maturity) ) ) / ( ( Face Value + Current Price ) / 2 ) Let's solve that for the problem we pose by default in ... Bond Equivalent Yield Formula | Step by Step ... - WallStreetMojo Formula to Calculate Bond Equivalent Yield (BEY) The formula is used in order to calculate the bond equivalent yield by ascertaining the difference between the bonds nominal or face value and its purchase price and these results must be divided by its price and these results must be further multiplied by 365 and then divided by the remaining days left until the maturity date. Excel yield to maturity formula - fuphyc.fxyaru.info The calculator uses the following formula to calculate the yield to maturity : P = C× (1 + r) -1 + C× (1 + r) -2 + . . . + C× (1 + r) -Y + B× (1 + r) -Y. Where: P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to ...

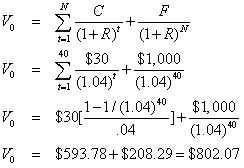

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically the ... Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

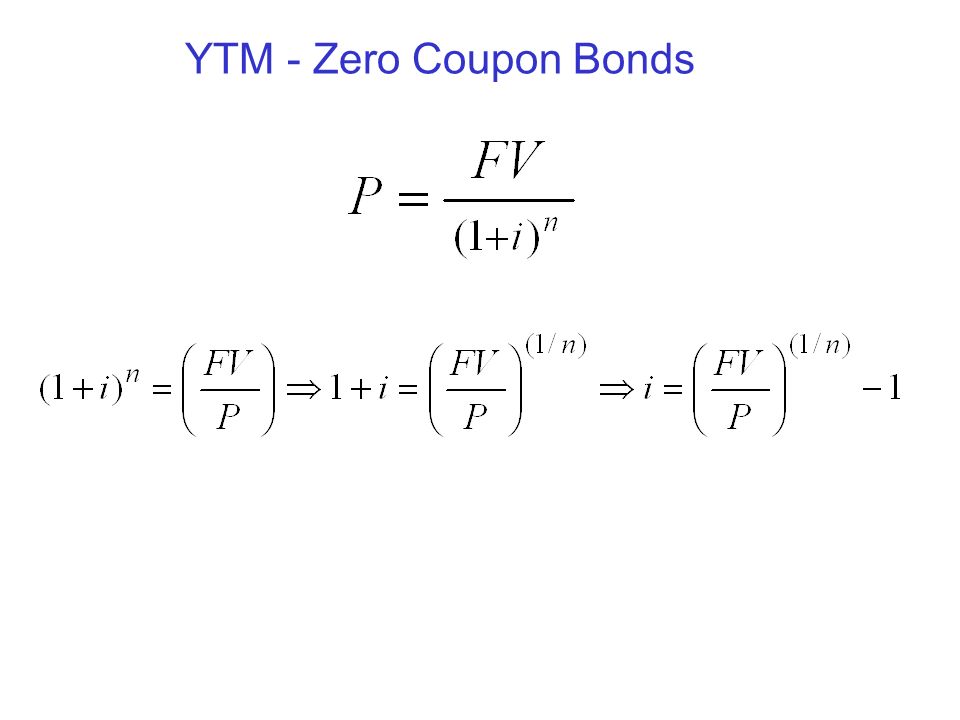

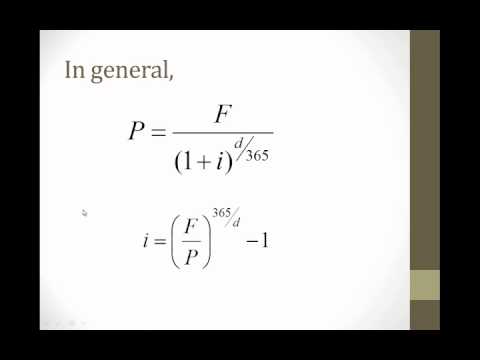

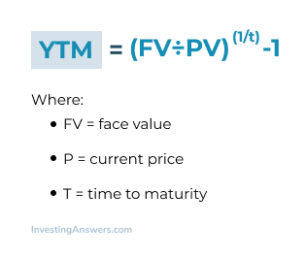

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2 ; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a … Yield to Maturity (YTM) - Overview, Formula, and Importance The yield to maturity is estimated using the formula below. Where, C = Coupon F = Face Value P = Price n = Years to maturity For instance, if a bond costs $920 and has a $1,000 face value, which is usually the face value of many bonds. Assume that there are 10 years before maturity, the annual coupons are $100, and the coupon rate is 10%. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Bond Yield: Formula and Calculator - Wall Street Prep Current Yield of Bond. The coupon rate ("nominal yield") represents a bond's annual coupon divided by its face (par) value and is the expected annual rate of return of a bond, assuming the investment is held for the next year. ... The inputs for the yield to maturity (YTM) formula in Excel are shown below. Yield to Maturity (YTM ...

Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator ... The YTM formula needs 5 inputs: bond price - Price of the bond; face value - Face value of the bond; ... In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year.

Yield to Maturity (YTM) - Overview, Formula, and Importance 07.05.2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity. The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different ...

Yield to Maturity Calculator | Good Calculators P is the price of a bond, C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to ...

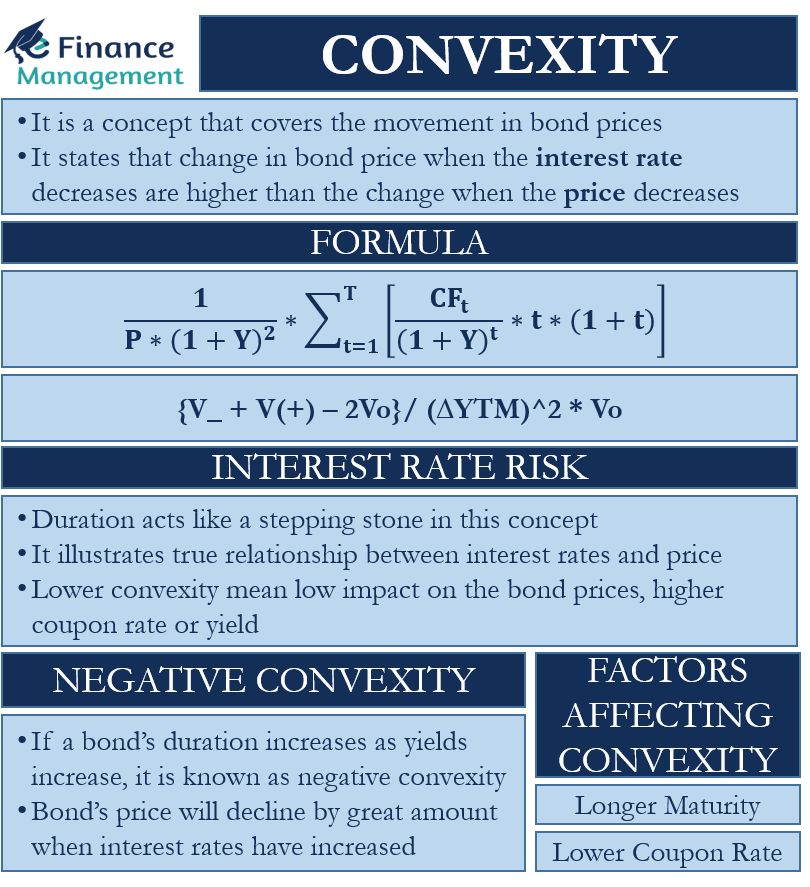

Bond Yield Formula | Step by Step Calculation & Examples Bond Yield =5.2%; Hence it is clear that if bond price decrease, bond yield increase. Recommended Articles. This has been a guide to Bond Yield Formula. Here we discuss how to calculate bond yield along with practical examples and a downloadable excel template. You can learn more about financial analysis from the following articles –

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Current Yield vs. Yield to Maturity: What's the Difference? A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1.

Bond Yield: Definition, Formula, Understanding How They Work 02.08.2022 · The coupon yield — or coupon rate — is the interest you earn annually from a bond. For example, if you bought a bond for $100 and earned $5 in interest per year, that bond would have a 5% ...

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM. Mathematically, the formula for bond price using YTM is represented as, Bond Price = ∑ [Cash flowt / (1+YTM)t] Where t: No. of Years to Maturity

Bond Formula | How to Calculate a Bond | Examples with Excel Template Bond Formula - Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Bond Equivalent Yield | Formula, Example, Analysis, Conclusion In such cases, the investor returns will be the difference between the purchase price of the deep discount or zero-coupon bond and its maturity value. BEY is primarily used to calculate the value of such deep discount or zero-coupon bonds on an annualized basis. Bond Equivalent Yield Formula. d = days to maturity

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity

Yield to Maturity (YTM): Formula, Meaning & Calculation - ET … Price = Current Market Price of the Bond; Maturity = Time to Maturity i.e. number of years till Maturity of the Bond; Yield to Maturity Calculation of a Bond: How it is Done. Yield to Maturity (YTM) acts as an indicator of potential returns from a Debt Fund, hence understanding how it gets calculated is the key to getting a grip on how it will ...

write down the formula that is used to calculate the yield to maturity on a twenty year 12 coupon bo

YIELDS TO MATURITY ON ZERO-COUPON RONDS - Ebrary (2.1) where PV = present value, or price, of the bond, FV = future value, which usually is 100 (percent of par value) at maturity, Years = number of years to maturity, PER = periodicity - the number of evenly-spaced periods in the year; and APR PER = yield to maturity, stated as an annual percentage rate corresponding to PER.

Bond yield - Bogleheads The current yield formula is: Current Yield = Annual dollar coupon interest / Price. This formula does not take into account gains or losses if the bond was purchased at a discount or premium. [2] [3] For example: An 18-year, $1,000 par value, 6% coupon bond selling for $700.89 has a current yield of: 8.56% = $1,000 * 6% / $700.89.

Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%.

filmux top - xjypc.melintasiberita.info Define yield to maturity of a bond/security.Yield to Maturity or YTM is key ratio of fixed-income bond or security in terms of rate of return earned over the total period. YTM also known as interest rate to be received on a bond when a holder bought it and retained it till maturity.Theoretical formula to calculate the YTM (Yield to Maturity).Use the formula: The rate of yield comes out to be 0 ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "43 yield to maturity of a coupon bond formula"