45 present value of a zero coupon bond

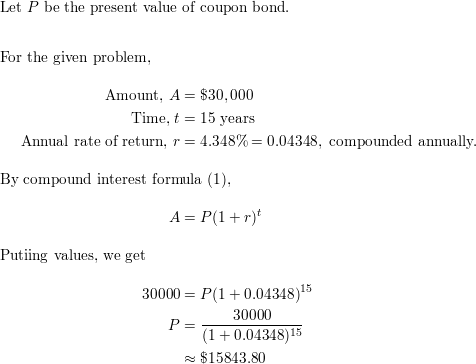

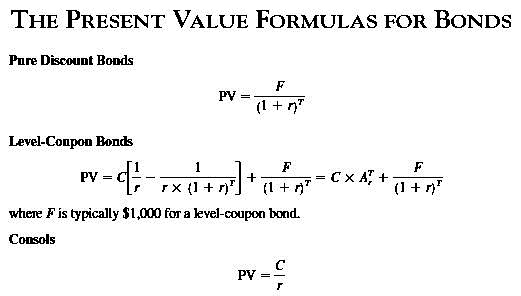

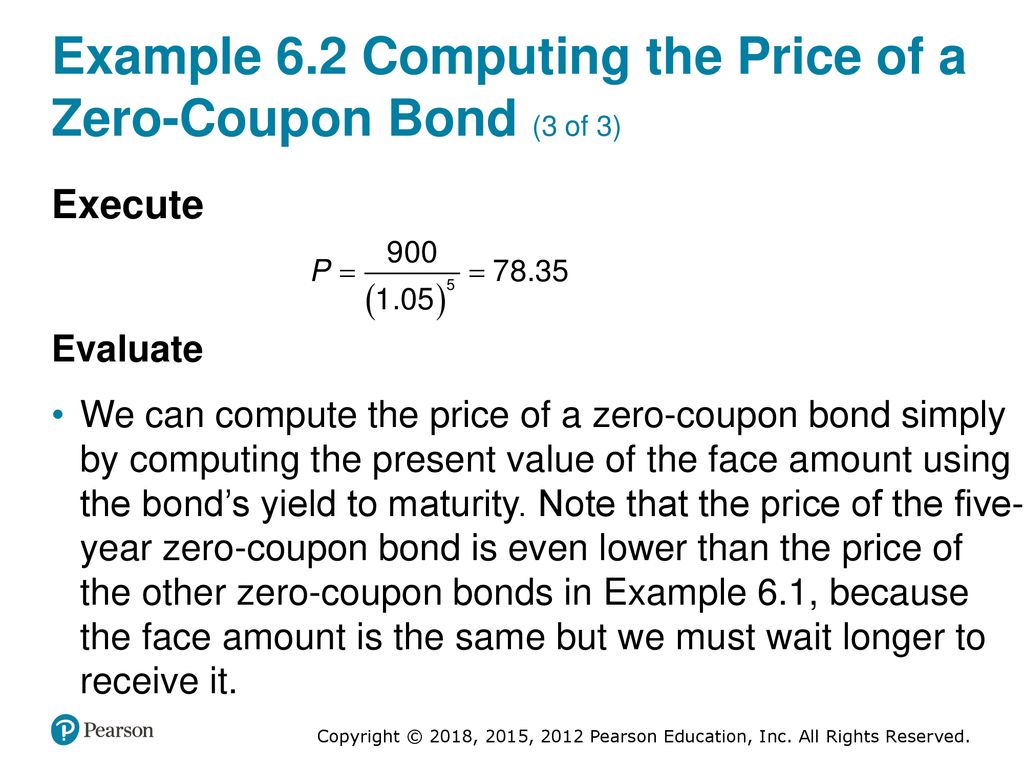

Zero Coupon Bond - Explained - The Business Professor, LLC Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r = Interest Rate n = # of Years until Maturity If an investor wishes to make a 4% return on a bond with $10,000 par value due to mature in 2 years, he will be willing to pay: $10,000 / (1 + 0.04)^2 = $9,245. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

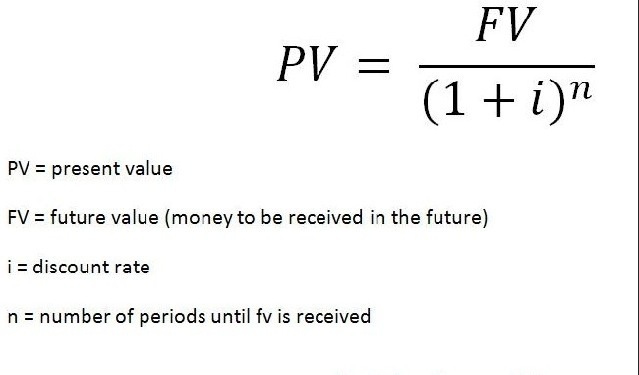

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator How do you value a zero-coupon bond? The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Present value of a zero coupon bond

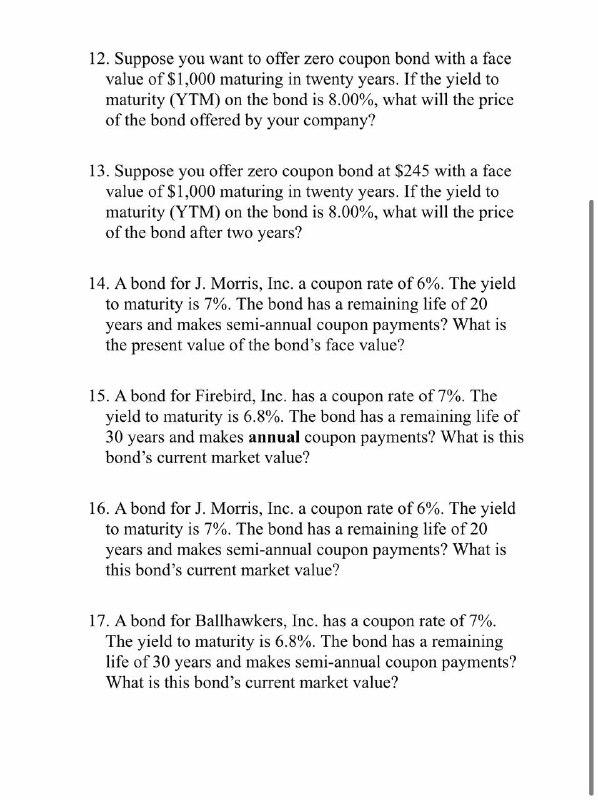

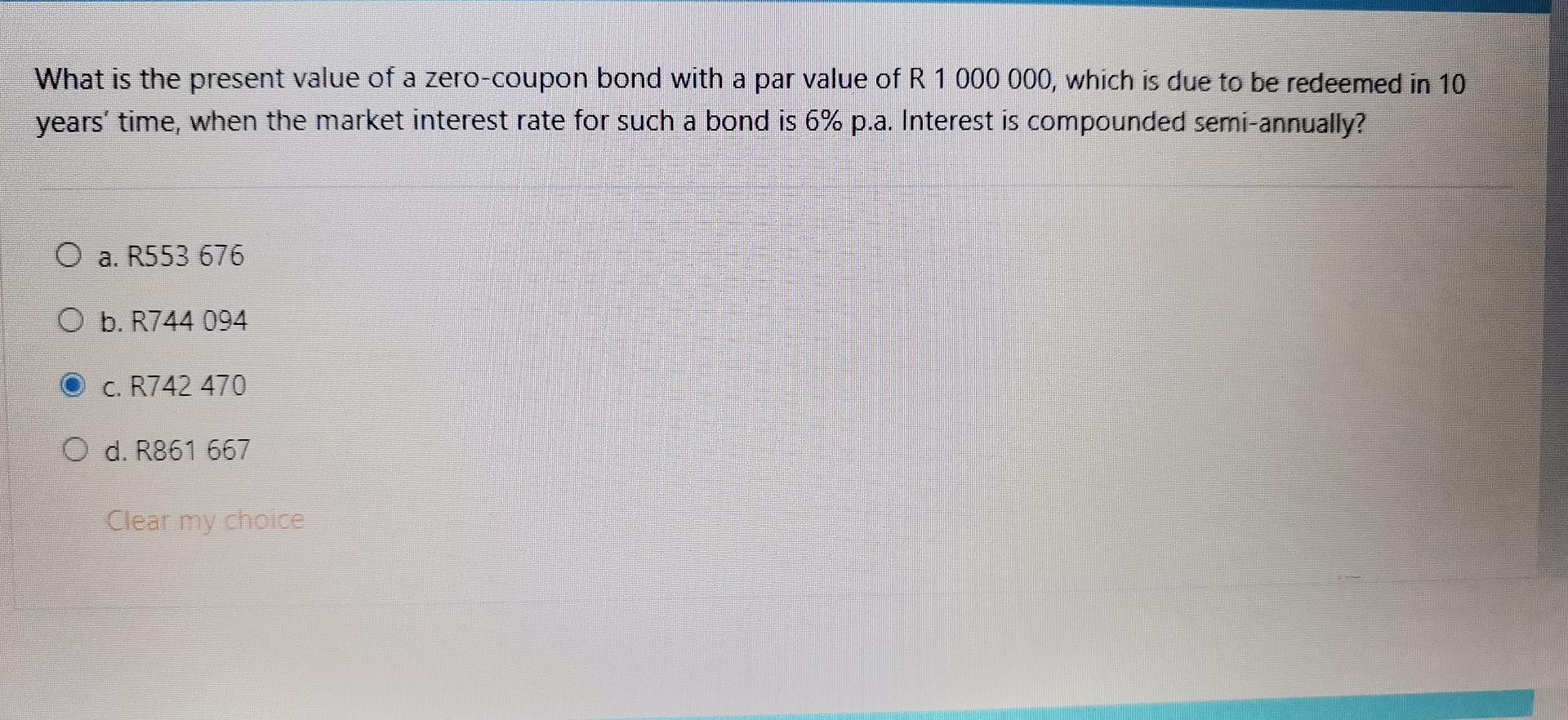

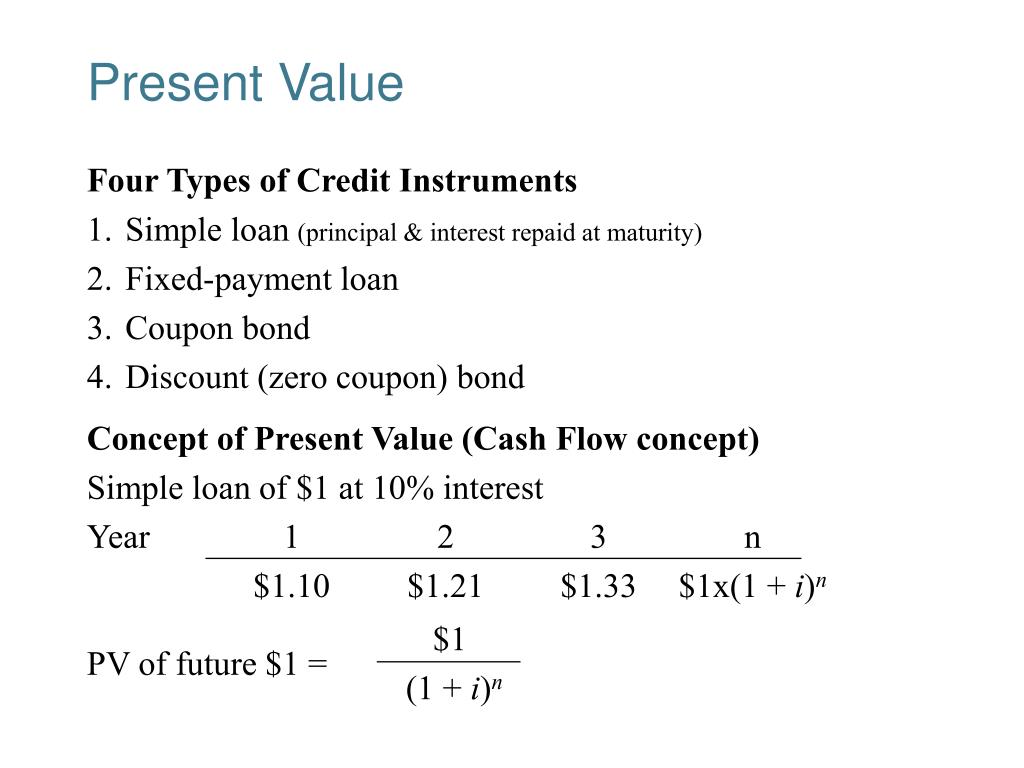

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Solved What is the present value of a zero-coupon bond with | Chegg.com What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 b. R744 094 c. R742 470 d. R861 667 Expert Answer Option a.) 14.3 Accounting for Zero-Coupon Bonds This can be found by table, by formula, or by use of an Excel spreadsheet 1. Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900. present value = $20,000 × $0.8900. present value = $17,800.

Present value of a zero coupon bond. Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg Question: 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. What is the bond's yield to maturity? This problem has been solved! Zero Coupon Bonds Explained (With Examples) - Fervent For a deep discount bond, the coupon is of course equal to 0. So the equation changes to this: Which in turn simplifies to this, since 0 divided by anything is equal to 0. In other words… The value of a zero coupon bond is nothing but the Present Value of its Par Value. Zero Coupon Bond Example Valuation (Swindon Plc) Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Calculate the Value of a Zero-coupon Bond - Finance Train Calculate the Value of a Zero-coupon Bond Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. What is the appropriate price for this bond? Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity.

Zero Coupon Bond Value Formula - Crunch Numbers Let's assume an investor wants to buy a zero-coupon bond and wants to evaluate what YTM of this bond would be. The face value of the bond is $10,000. The price of the bond is $9,100. There are 2 years until maturity. YTM = \sqrt [2] { \frac {10,000} {9,100} } - 1 = 4.83\% Y T M = 2 9,10010,000 −1 =4.83% YTM of this bond is 4.83%. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps: How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left... Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

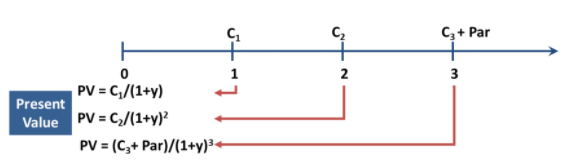

Zero Coupon Bonds - Financial Edge Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 . Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value ... 14.3 Accounting for Zero-Coupon Bonds The price of the bond is determined by computing the present value of the required cash flows using the effective interest rate negotiated by the two parties.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond: Formula and Calculator [Excel Template] If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Zero-Coupon Bond Value Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods

Zero Coupon Bond Calculator - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top.

Zero Coupon Bond Calculator – What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero Coupon Bond | Definition, Formula & Examples A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%...

How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

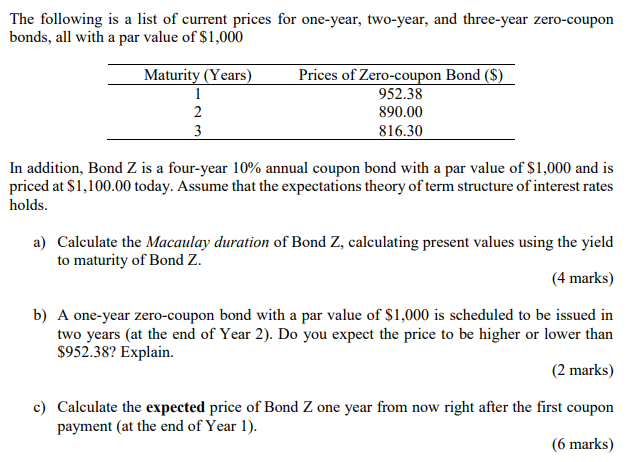

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

14.3 Accounting for Zero-Coupon Bonds This can be found by table, by formula, or by use of an Excel spreadsheet 1. Because the actual payment is $20,000 and not $1, the present value of the cash flows from this bond (its price) can be found as follows: present value = future cash payment × $0.8900. present value = $20,000 × $0.8900. present value = $17,800.

Solved What is the present value of a zero-coupon bond with | Chegg.com What is the present value of a zero-coupon bond with a par value of R 1 000 000, which is due to be redeemed in 10 years' time, when the market interest rate for such a bond is 6% p.a. Interest is compounded semi-annually? a. R553 676 b. R744 094 c. R742 470 d. R861 667 Expert Answer Option a.)

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/08135541/Zero-Coupon-Bond-Calculator.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

Post a Comment for "45 present value of a zero coupon bond"