45 ytm zero coupon bond

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Zero Coupon Bond: Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

Solved What is the YTM of a twenty-year zero coupon bond - Chegg Expert Answer 5.54% Face value of bond is $ 1000 which is paid at the end of maturit … View the full answer Transcribed image text: What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68% Previous question Next question

Ytm zero coupon bond

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3. Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ... Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

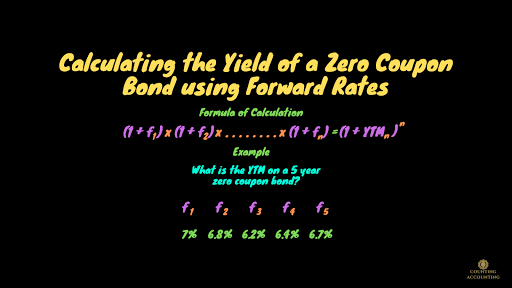

Ytm zero coupon bond. Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond. Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube - Otosection Contact creators works features amp terms privacy advertise new creators- copyright us safety About contact test press how developers policy press us copyright CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Zero Coupon Bond Questions and Answers - Study.com View Answer. Compute the yield for a $1000 face value zero coupon bond that sells currently for $280 and matures in 20 years. View Answer. Compute the issue price of each of the following bonds. a. $10,000,000 face value, zero-coupon bonds due in 20 years, priced on the market to yield 8% compounded semiannually. b.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox The price of a zero coupon bond is calculated using the YTM formula. If the above formula is rearranged to calculate for the price, then the market price of the bond will be: Present value = ( Face value / (1+YTM)^n) - 1 How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The stated yield to maturity and realized compound yield to | Quizlet In which one of the following cases is the bond selling at a discount? (1) Coupon rate is greater than current yield, which is greater than yield to maturity. (2) Coupon rate, current yield, and yield to maturity are all the same. (3) Coupon rate is less than current yield, which is less than yield to maturity. Yield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

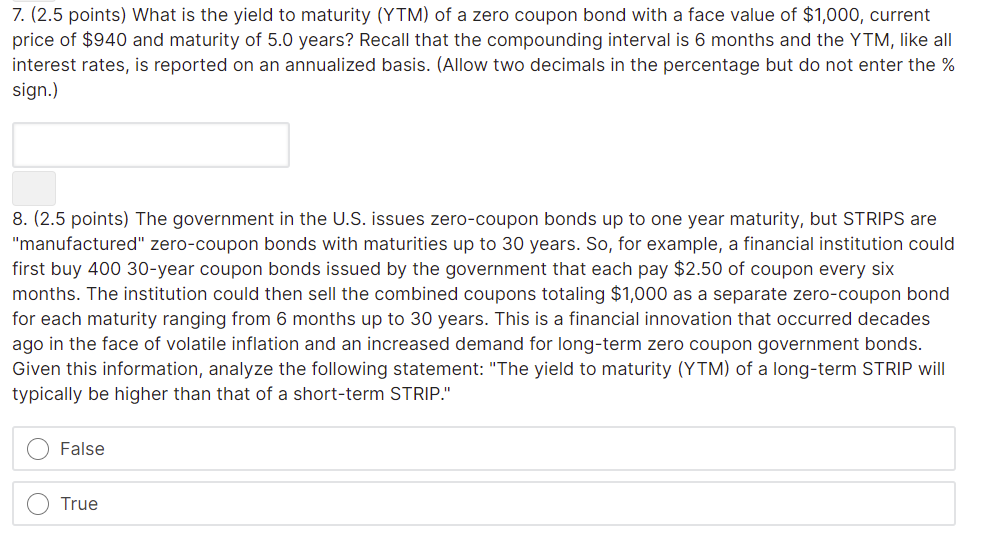

What is the yield to maturity (YTM) of a zero coupon bond with a face ... Answer (1 of 2): YTM is 5.023%. Bond mathematics tend to be easier to calculate on a spreadsheet as seen below: Calculated the Yield first using RATE function. Parameters can be found out using the 'fx' button in MS Excel. You can see the parameters used in the above image as well viz. B6*B7 ->...

Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Zero Coupon Bonds - Financial Edge What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the formula mentioned above gives 862.6 as the bond's present value. Calculating yield-to-maturity or expected returns. Yield to maturity (YTM) is the expected return on a bond if it is held until maturity.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Solved What is the YTM of a twenty-year zero coupon bond - Chegg What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.75% 5.54% 5.68% 5.85%

YTM for a zero coupon bond? | Forum | Bionic Turtle While solving one of the questions i came to a section where I was to calculate the YTM of a zero coupon bond. i had the term and the price of the bond. Thinking that zero coupon bond has just one payment, i calculated the discount rate using term, par value and the price. To my surprise the value that I got was different to what my calc gave me..

Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

ytmZeroCouponBond: Calculates the Yield-To-Maturity(YTM) of a Zero ... The method ytmZeroCouponBond () is developed to compute the Yield-To-Maturity a Zero-Coupon Bond. So, ytmZeroCouponBond () gives the Price of a Zero-Coupon Bond for values passed to its three arguments. Here, maturityVal represents the Maturity Value of the Bond, n is number of years till maturity, and price is Market Price of Zero-Coupon Bond.

Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula...

Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · For example, a bond with a $1,000 par value and a 7% coupon rate pays $70 in interest annually. Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "45 ytm zero coupon bond"