39 coupon paying bond formula

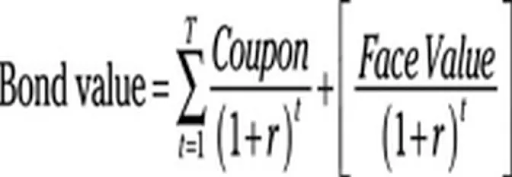

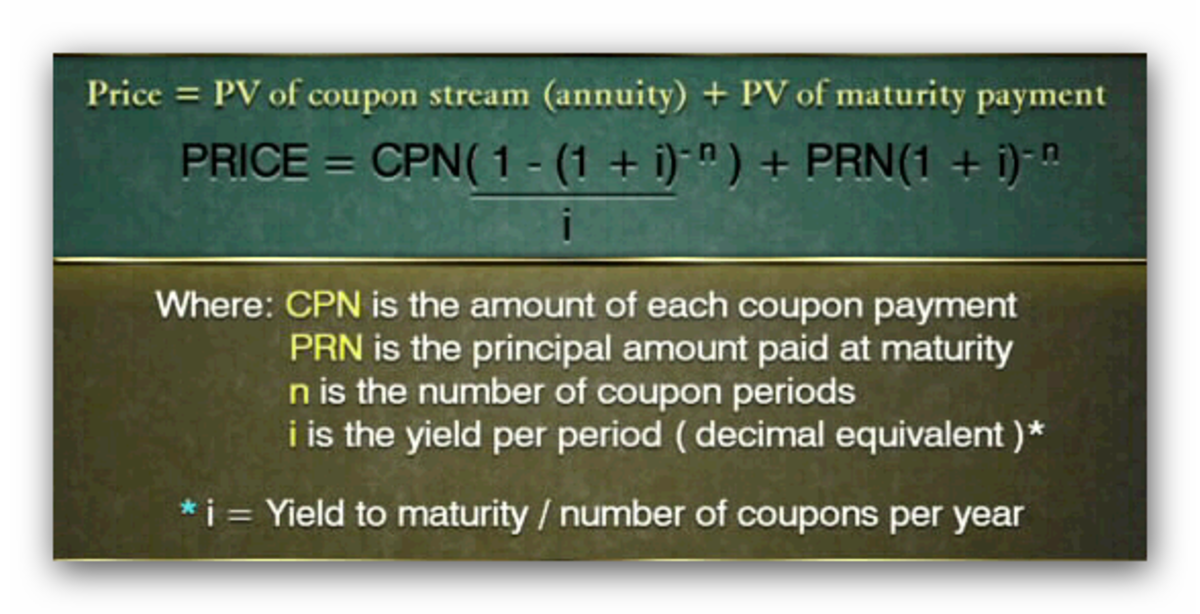

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Current Yield of Bond Formula - EDUCBA Let us take the example of a 10-year coupon paying a bond that pays a coupon rate of 5%. Calculate the current yield of the bond in the following three cases: Bond is trading at a discounted price of $990. Bond is trading at par. Bond is trading at a premium price of $1,010.

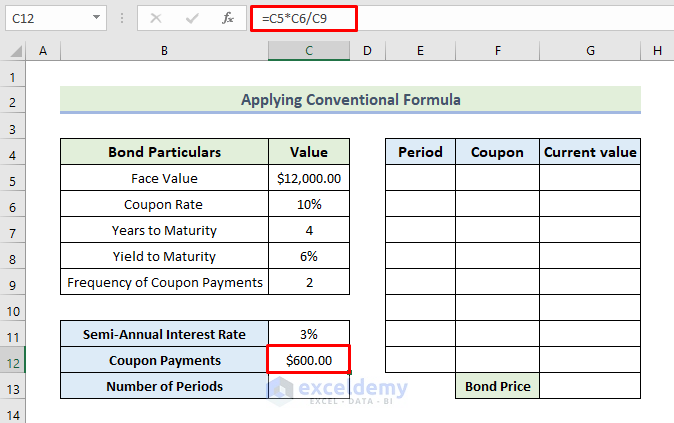

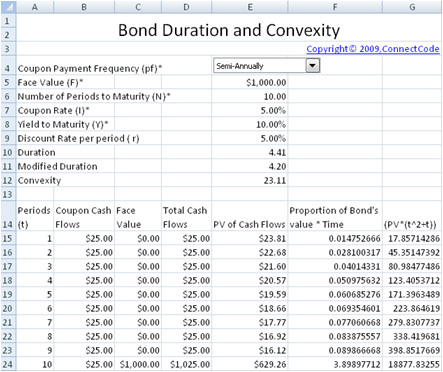

Bond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Coupon paying bond formula

Home | NextAdvisor with TIME Today Is the Last Day to Lock in a 9.62% I Bond Rate. We Answer Your Questions 7 min read. You Can Earn 3.00% with a Capital One Savings Account. How to Maximize Higher Interest Rates CBS New York - Breaking News, Sports, Weather, Traffic and ... CBS News Live CBS News New York: Local News, Weather & More Nov 1, 2018; CBS News New York PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

Coupon paying bond formula. Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... CBS New York - Breaking News, Sports, Weather, Traffic and ... CBS News Live CBS News New York: Local News, Weather & More Nov 1, 2018; CBS News New York Home | NextAdvisor with TIME Today Is the Last Day to Lock in a 9.62% I Bond Rate. We Answer Your Questions 7 min read. You Can Earn 3.00% with a Capital One Savings Account. How to Maximize Higher Interest Rates

Post a Comment for "39 coupon paying bond formula"