44 are zero coupon bonds taxable

CBDT amends Income Tax rule 2F & rule 8B & release new Form No. 5B & 5BA 06 Apr 2022. 2,973 Views. 0 comment. CBDT amends Income Tax rule 2F, rule 8B and introduces new FORM NO. 5B - Application for notification of a zero coupon bond under clause (48) of section 2 of the Income-tax Act, 1961 and Form No. 5BA - Certificate of an accountant under sub-rule (6) of rule 8B vide Notification No. 28/2022-Income-Tax ... Tax-exempt wealth building with zero coupon municipal bonds The following example shows how a zero coupon municipal bond strategy can work for a retiring couple interested in tax-free income to supplement their ...2 pages

› fixed-income-bonds › individualUS Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity ...

Are zero coupon bonds taxable

ZERO COUPON GOVERNMENT BONDS - The Economic Times The government is unlikely to take zero-coupon bond route to further recapitalise public sector banks after the Reserve Bank expressed some concerns in this regard, sources said. 28 Mar, 2021, 12.29 PM IST › ask › answersHow Are Corporate Bonds Taxed? - Investopedia They are exempt from federal income taxes, and if you buy them in the state where you live they are exempt from state and local taxes. 3 On the other hand, there are zero-coupon bonds that have tax... Understanding Zero Coupon Bonds - Part One - The Balance You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

Are zero coupon bonds taxable. Tax Advantages of Series I Savings Bonds - The Balance This is due to the fact that they are a special type of bond known as a "zero-coupon," meaning that you won't receive regular checks in the mail; instead, the interest you earn is added back to the bond's value, and you'll earn interest on your interest. ... The Series I bond tax benefits are identical to those of Series EE savings bonds. What Are Corporate Bonds? What You Need To Know | GOBankingRates The interest rate, sometimes called the coupon rate, tells you how much interest you will earn on the bond. Interest on corporate bonds is usually paid twice per year, but the interest rate is expressed in annual terms. If you purchase a bond with a par value of $1,000 and a coupon rate of 10%, you will get $100 in interest each year, in two ... › article › understanding-bondsUnderstanding Bonds: The Types & Risks of Bond Investments Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and the investor then receives the full face value of the bond at maturity. All bonds carry some degree of "credit risk," or the risk that the bond issuer may default on one or more payments before the bond reaches maturity. Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

Guide to Investment Bonds and Taxes - TurboTax Tax Tips & Videos If half of your Social Security benefit plus other income, including tax-exempt muni bond interest, is between $32,000 and $44,000 for a joint tax return ($25,000 to $34,000 for single filers), up to 50% of your Social Security benefits may be taxable. Above those thresholds, up to 85% of your benefits could be taxed. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Zero-coupon bonds are a special case. You might have to pay tax on their interest income — even though you don't actually receive any interest. With a zero-coupon bond , you buy the bond at a... Zero-Coupon Convertible - Investopedia A zero-coupon convertible can also refer to a zero-coupon issued by a municipality that can be converted to an interest-paying bond at a certain time before the maturity date. When a municipal... Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Types of Municipal Bonds and Their Risks | Intuit Mint The bond funds are used to fund projects that are not subsidized by the federal government because they do not directly benefit the public, and are therefore not considered tax-exempt. However, taxable municipal bonds tend to offer higher interest rates, which can make them an attractive option for certain investors. Zero-coupon bonds Zero-Coupon Bond Definition - Investopedia The imputed interest on the bond is subject to income tax, according to the Internal Revenue Service (IRS). Therefore, although no coupon payments are made on zero-coupon bonds until maturity,... What are Zero Coupon Bonds? Who Should Invest in Them? Long-term zero coupon bonds are generally issued with maturities of 10 to 15 years. There is an inverse relationship between the time and the maturity value of a zero coupon bond. The longer the length until a zero-coupon bonds maturity date the less the investor generally has to pay for it. Zero coupon bonds with a maturity of less than a year ... What Is a Zero-Coupon Bond? | The Motley Fool Depending on the issuer, zero-coupon municipal bonds may generate tax-free imputed income, which means you won't have to pay tax until the bond matures -- usually many years in the future....

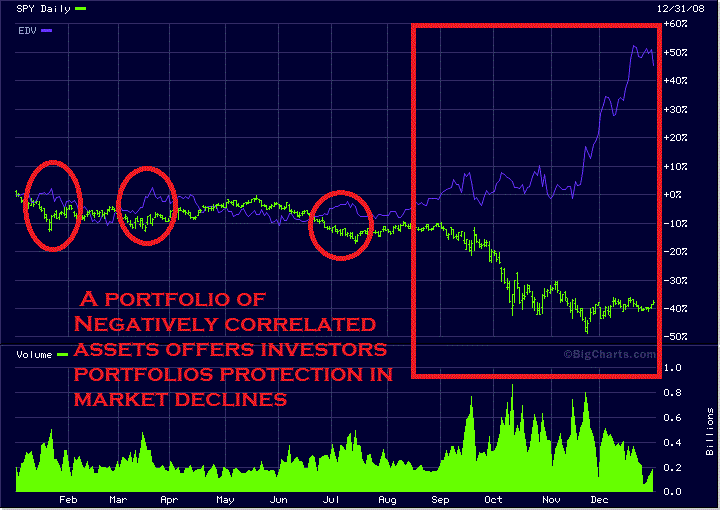

Zero Coupon 2025 Fund | American Century Investments 2013 Tax Form 8937 ... Invests in zero-coupon bonds, providing a dependable rate of return if held to maturity. Performance. Data reflects past performance for Investor Class shares, assumes reinvestment of dividends and capital gains and is no guarantee of future results. Current performance may be higher or lower than data shown.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example How Is the Income From a Zero-Coupon Bond Taxed? Despite the fact that zero-coupon bonds don't actually pay interest, bondholders are still subject to any applicable taxes on their imputed interest...

Understanding Bond Yields and the Yield Curve #Bonds #YieldCurve # ... Understanding Bond Yields and the Yield Curve When it comes to investing in bonds, one of the first factors to consider is yield. But what exactly is "y

Zero-coupon CDs: What they are and how they work - Bankrate You'll also have the hassle of finding a new place to invest the money. Taxes on interest that hasn't been received The biggest disadvantage of a zero-coupon CD is you'll have to pay taxes on the...

The ABCs of Zero Coupon Bonds - Tax & Wealth Management

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2. Market-Linked Bonds Market-linked bonds offer fixed interest, and the interest rates are linked to the index it is tracking.

Taxability of Zero Coupon Bonds - Income Tax - CAclubindia As far as i know Notified Zero Coupon Bonds are taxable under Capital Gains and Non Notified ZCB are taxable as interest. However i cannot find L&T name in here ( ) So shall this be shown as interest income in ITR or should be shown under Capital Gains?

Taxable Bond Definition - Investopedia Examples of Taxable Bonds Consider a zero-coupon bond and Treasury bill, which do not pay interest for the duration of the bond's life. Instead, they are offered at discounts and redeemed at par...

Tax Treatment of Bonds and How It Differs From Stocks Corporate bonds have no tax-free provisions. You will pay taxes on any earnings from these debt securities. However, if they're held in a retirement account like a 401 (k) or IRA, you won't owe tax on their earnings until you withdraw them in retirement. 3 Zero-coupon bonds have specific tax implications.

What Are Treasury STRIPS? - Investment Guide - SmartAsset When stripping of Treasury bonds began, the government discouraged the practice due to concerns about lost tax revenues. However, in 1982 tax laws were modified to change tax treatment of zero-coupon bonds.The Treasury department then accepted stripping and also began issuing bonds electronically, without paper certificates or coupons.

Advantages and Risks of Zero Coupon Treasury Bonds If issued by a government entity, the interest generated by a zero-coupon bond is often exempt from federal income tax, and usually from state and local income taxes too. Various local...

Taxation of Debt Instruments by Bathiya.com Some of the important and widely used debt instruments are Non-Convertible Debentures, Zero Coupon Bonds, Redeemable Preference Shares, Deep Discount Bonds, Units of Debt Oriented Mutual Funds, Units of Real Estate Investment Trusts, Units of Infrastructure Investment Trusts, etc. A. Tax treatment of Debt Instruments- from Issuer's perspective

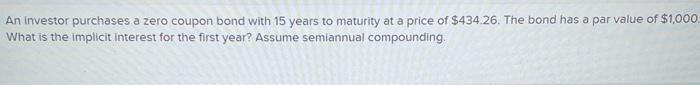

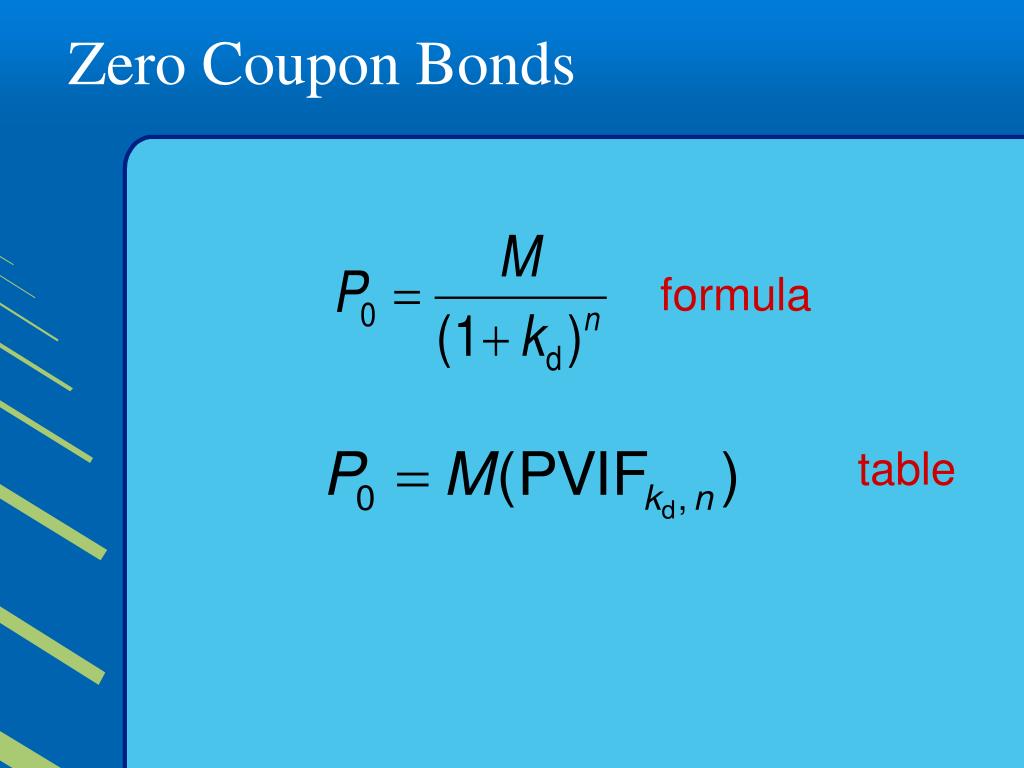

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Understanding Zero Coupon Bonds - Part One - The Balance You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

› ask › answersHow Are Corporate Bonds Taxed? - Investopedia They are exempt from federal income taxes, and if you buy them in the state where you live they are exempt from state and local taxes. 3 On the other hand, there are zero-coupon bonds that have tax...

ZERO COUPON GOVERNMENT BONDS - The Economic Times The government is unlikely to take zero-coupon bond route to further recapitalise public sector banks after the Reserve Bank expressed some concerns in this regard, sources said. 28 Mar, 2021, 12.29 PM IST

Post a Comment for "44 are zero coupon bonds taxable"